Your business’s value proposition explains through the lens of your customer, why they should do business with you over your competitors. With most of us now living under tight government restrictions, our needs and priorities have shifted dramatically. In order to protect revenue streams and open up new ones, SMEs need to adapt their value proposition to this ‘new normal’.

What services or features do you promote to prospective customers that converts them into paying customers?

What benefits do you offer that meets their needs and priorities and preferences?

Rounding these features or benefits up into a clear and concise message is what makes a good value proposition.

Credit: © Business 2 Community

The problem with your current value proposition

The disruption to businesses due to the coronavirus has been unprecedented. The problem most businesses face is that their value proposition was designed for normal conditions. It’s (understandably) never been ‘stress tested’ to understand how successful it would be during a global medical emergency.

As a result, the value proposition of most businesses is currently either;

- not in sync with the current needs and preferences of prospective customers

- completely null and void as a result of the coronavirus restrictions.

Fortunately, most businesses fall into the first rather than second category.

Unlikely: null and void

The value proposition of an airline such as Easyjet will be centred around providing a quick and convenient transport solution for passengers wishing to travel across the continent.

Whilst this has proven to be a hugely successful marketing message over the past 25 years, Easyjet’s value proposition is completely null and void in a world where air travel is banned due to current coronavirus restrictions. The value once provided to customers (cheap, convenient, no frills air travel) simply no longer exists when the industry your business operates within, has effectively been shutdown by current government restrictions.

If this applies to your business, please click here to access our Government Support page or contact us immediately for a free review of the support and solutions available to you.

Likely: out of sync

Most businesses however will to a certain degree, be able to adapt their value proposition to fit the unusual conditions we all find ourselves living in. Some will be severely impacted and need to make quite drastic changes to maintain even a fraction of normal sales:

- Restaurants, bars and pubs

- Events planning and other hospitality businesses

- Retail and other brick & mortar businesses

- Travel agents

Others businesses however can tweak their messaging and be far more adaptable to the needs of prospective customers; especially SMEs who work with other SMEs:

- Marketing agencies

- Accountants

- Corporate lawyers

- IT Support

Key Takeaway: as part of your COVID-19 Action Plan, SMEs need to:

- Assess how your customers needs have changed as a result of COVID-19

- Assess how you can realign your services to adapt to this ‘new normal’

How your customers needs have changed as a result of COVID-19

Customer delivery

Given most us have now been told to stay at home, savvy businesses realise that their goods and services can effectively only be delivered in one of two ways; either

- Digitally / online or;

- Delivered to your customer’s doorstep.

Even businesses in the ‘hardest hit’ sectors are finding innovative and creative ways to adapt to these conditions. Pubs for instance have started offering food delivery services whilst brewers have begun delivering crates of beer directly to your doorstep. This in turn will help make up for B2B sales lost or delayed by the Brewer as a result of the coronavirus.

Harrogate brewery Roosters new Take-Home delivery service. Credit: Harrogate Advertiser

It’s not possible to manoeuvre and adapt in this way if you’re industry has been effectively shutdown by the coronavirus lockdowns. But for many businesses, including even pubs and brewers, it’s possible to make adjustments to customer delivery to either preserve existing sales revenue streams or create brand new sales channels.

Key Takeaway: review how your service delivery needs to be updated to reflect your customer’s current situation, needs and preferences, and in turn protect your own cash flow.

Customer priorities and goals

Other than reviewing delivery channels, there are more direct ways you can update your value proposition to better reflect the current needs and preferences of your customers.

Your prospective customers (whether you’re B2C or B2B) will be affected by the coronavirus shutdown to different degrees:

- Those worst affected may be working out how to survive the next few months.

- Both businesses and individuals will be cutting costs and slashing budgets due to lower expected sales / income in 2020 and into 2021.

- Both will be delaying big spending decisions until there is more certainty, less volatility, and better access to markets.

This of course has led to many SMEs seeing future billable work cancelled, sales pipelines dry up and upcoming contracts indefinitely pushed back.

Key Takeaway: review how your customer needs and priorities will have changed as a result of COVID-19 and to what degree. This will help you consider how out of sync your current offering (and value proposition) is with their current needs and priorities.

Adapting your value proposition to meet current customer needs

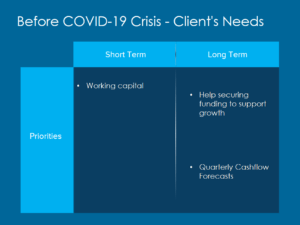

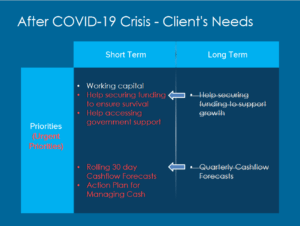

A good visual tool you can use to assess these changing needs is by drafting a matrix such as below. First, draft a table to show your customer’s goals and how what you offer addresses their ongoing needs and priorities under more stable and normal times. Then draft a second table to illustrate how your customer’s priorities and needs have shifted as a result of COVID-19.

For example, our value proposition is typically based around supporting our client’s growth plans. So in terms of funding and cash, a couple of elements of our value proposition is based around helping SMEs secure financing and work out how it should be spent in order to support their long term growth plans.

As a result of COVID-19, SMEs still need access to funding and cash. Sometimes it will be still be to support growth but due to the coronavirus, SMEs will for the most part require external finance to ensure survival and solve urgent cash flow issues. That means forecasting cash accurately, identifying gaps and ensuring they secure the necessary finance to reduce the impact of COVID-19 as quickly as possible.

Appreciating how drastically our customer’s needs and priorities have changed allow us as business advisers and accountants in turn, to adapt our services and advice to better meet their current challenges and priorities.

Preparing your business for COVID-19

A key part of your COVID-19 Risk Assessment and Action Plan should therefore involve reviewing how existing services and offerings can be adapted to better meet the needs of customers, which will inevitably have shifted drastically over the past week as a result of the coronavirus shutdown.

Businesses need to adapt to this ‘new normal’ as soon as possible. Doing so will help businesses retain a strong value proposition; protecting your existing revenue streams and potentially opening up new ones.

Need support with your COVID-19 Action Plan?

Concerned about the impact the coronavirus is having on your business?

Need help understanding what Government Support is available?

Book a free Business Health Check with a Chartered Accountant who will help answer your questions and review what solutions and financial support are available to your business: Book Now

Read our free resource on how to access the Coronavirus Government Support announced for businesses so far: Read Now

Access our free COVID-19 Action Plan to understand what areas of your business you need to review: Download Now

Have questions? Leave your details below and we’ll get back to you as soon as possible: