The Coronavirus Job Retention Scheme means that if staff are unable to work due to COVID-19, the government will pay 80% of the “full employment costs, up to a cap of £2,500 per month”. We have prepared guidance on eligibility, what is meant by “employment costs” and the how impacts your cash flow and staffing plans – see here.

What is clear is the calculation and claim process is not quite as simple as might be thought. When the scheme launches later this month, claims will undoubtedly be prone to error and even fraud. The 80% rule sound simple on the surface but from the examples made available so far, it appears that it is not as simple as taking 80% of the salary, NI and pension contributions for a month.

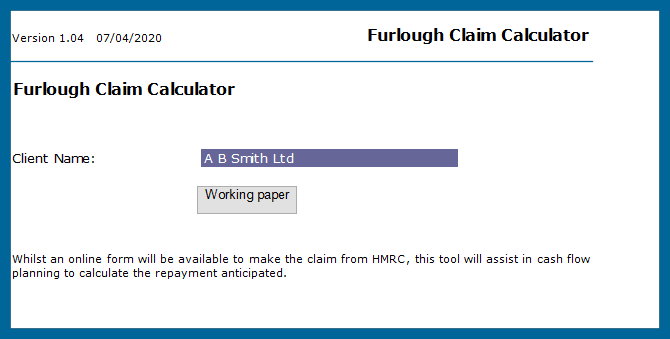

Using our Furlough Claim Calculator, we can calculate and submit your claim. This tool will also assist in cash flow planning and accurately calculating the repayment anticipated. Get in touch by using the form on this page or use the live chat for CJRS assistance.

Support is available

Concerned about the impact the coronavirus is having on your business? Need help developing your business during COVID-19? Need help accessing Government Support?

- Book a free Business Health Check we'll answer your questions and review what solutions and financial support are available to your business: Book Now

- Read our free resource on how to access the Coronavirus Government Support announced for businesses so far: Read Now

- Access our free COVID-19 Action Plan to understand what areas of your business you need to review: Download Now

- Have questions? Leave your details below and we’ll get back to you as soon as possible: