The Coronavirus Business Interruption Loan Scheme (CBILS for short) was officially launched on 23rd March. Using the insights and information about the scheme to date, we shed light on whether you are eligible for a Government Backed Loan, how to increase your chances of being accepted, fast tracking your application and other vital points you need to be aware of.

Unfortunately, many business owners have struggled to obtain a CBILS backed loan or have been unwilling to proceed due to the potential risks and debt involved.

Banks and other lenders taken different approaches which has caused confusion about eligibility, interest rates and the type of supporting information required as part of the process (some of which is proving challenging and complex to prepare).

The government revamped the scheme on 2nd April in response to these criticisms and make it easier for businesses to access the loans. As we discuss below, the changes announced to the CBILS yesterday mean thousands of additional businesses will now be eligible who would not have been under the original rules.

With this confusion, we have used the information, insights and learnings about CBILS so far to provide 8 points which will help you:

- Understand whether you’re eligible and should apply

- Fast track the application process

- Increase your chances of being approved for a Coronavirus Emergency Loan.

Approach your current bank provider first; some banks are not accepting CBILS applications from non-account holders

Your first port of call should be your current bank provider. This is because some banks are not accepting CBILS loan applications if you are not currently a customer.

This is problematic as CBILS is not offered by all banks; including the new challenger banks such as Revolut, Monzo and Starling. Not all hope is lost however. CBIL loans are offered by 40 lenders including high street banks as well as specialised lenders. A full list is available here.

If you are applying for a CBILS loan, accelerate the process by applying to multiple lenders via a single application form

Many businesses are in a precarious cash flow position and need financing as soon as practically possible. Firms should therefore look to explore ways to accelerate the application process and increase the likelihood of being approved.

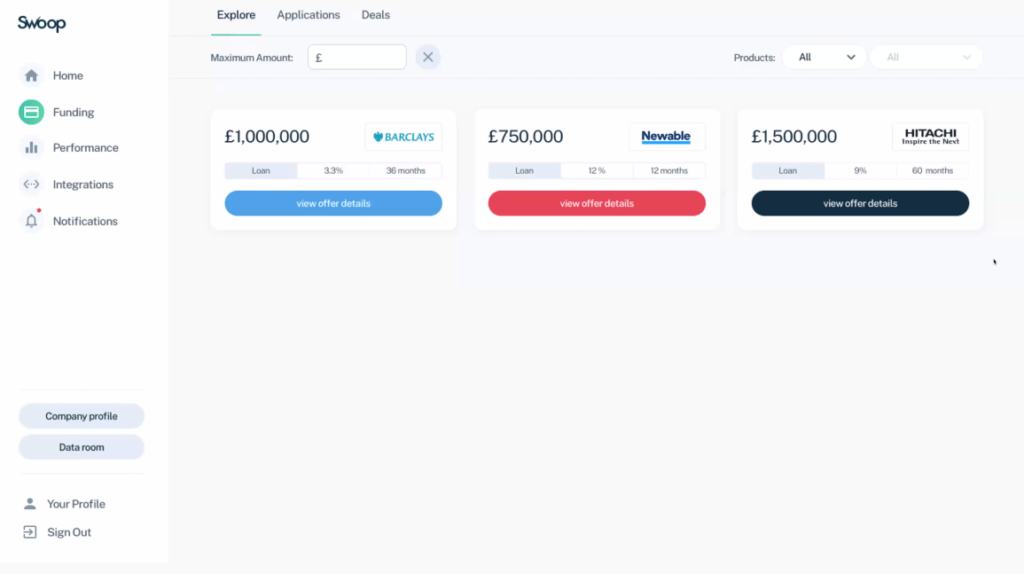

To do this, we recommend using a funding platform such as Capitalise. Using Capitalise or an equivalent platform such as Swoop, you can apply to up to 10 lenders who support the CBILS loan scheme through a single application as well as over 100 other lenders who have proven track records of borrowing to small and medium businesses.

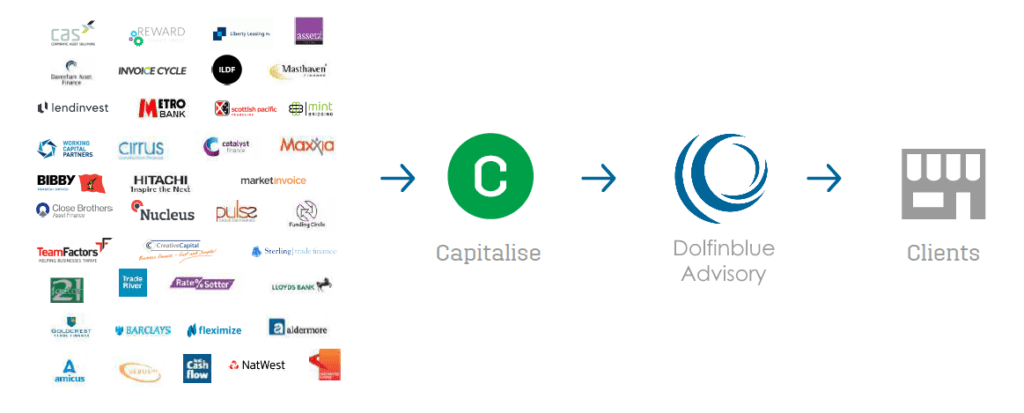

We partner with Capitalise to make it easy for businesses to access funding quickly and efficiently. If you would like a free consultation to understand the information and evidence required to apply via Capitalise, you can book time to speak with one of our team using the link below.

Book a free consultation to streamline your CBILS application through Capitalise

A CBILS loan application will need to be supported by a detailed financial plan

If you are approaching banks and lenders individually, each will have a different approach. Nonetheless, your application will need to be supported by a financial plan so the lender can assess the viability of your loan and the firm’s ability to repay.

Your financial plan will likely need to include:

Detailed 12 month cash flow forecasts

Depending on the complexity and size of loan you may be asked for anything up to 3 year forecasts. However, 12 months may also be sufficient. Your forecast should likely include a 3-6 month period of severe disruption followed by a period of performance similar to how the business was performing prior to the impact of coronavirus. Of course, this will depend on your sector and a detailed assessment of how severely the business has been affected by the COVID-19 shutdown.

Indeed, it may be difficult to forecast cash and sales over the next 3-6 months. We have put together a guide explaining how to forecast cash effectively over this period – see here.

You may also be asked to provide:

- Management accounts

- Full annual accounts covering your company’s last financial period.

- A business plan

NEW: You can now apply for a CBILS backed loan before applying for a commercial loan

When the scheme was initially launched, applications were limited to business who had been tried and failed to obtain a loan on normal commercial terms.

This changed on 2nd April when the government removed this restriction. You will now be able to apply for a CBILS loan even regardless of whether you have or have not been refused a loan on commercial terms. This will significantly increase the number of businesses eligible for the scheme.

You can only apply for a CBILS backed loan once every other government relief package has been taken

Whilst not common knowledge, the British Business Bank is trying to make it clear that CBILS can only be applied for once other government schemes, reliefs and support has been taken. This includes the VAT deferment, HMRC’s Time to Pay scheme, furloughing staff through the Coronavirus Job Retention Scheme and so on.

You can view a full breakdown of the government support announced to date here.

In this sense, CBILS should be your last port of call after all other available government reliefs have been considered and either ruled out due to ineligibility or applied for.

Once this has been ensured, the cash flow forecasts you submit as part of your loan application must include the government support you intend to claim. This will improve your chances of approval.

The borrower remains 100% liable for the repaying the loan

There is some confusion over the 80% guarantee the government is offering as part of the CBILS scheme. To avoid any doubt, this guarantee applies to the lender and the borrower (I.e. the business) remains 100% liable for the debt.

The 80% backing is intended to encourage banks to lend to businesses. If a business was to default, the government will repay 80% to the lender. Therefore, these are still loans that must be repaid by the business, like any other.

NEW: banks are now banned from asking business owners for personal guarantees for loans under £250,000

In addition to being 100% liable for the debt, we have seen many banks to date demand personal guarantees from business owners in order to secure the loan. This could be against the business owner’s personal savings or property they own.

This was a huge weakness and unfair aspect of the scheme as it meant the business and now the business owner were forced to accept the majority of the risk.

This has now changed following the governments revamp of the CBILS on 2nd April when it was announced that if a business was applying for a CBILS loan of up to £250,000, banks will no longer be allowed to ask business owners to guarantee repayments with personal savings or assets. For loans above £250,000, banks will only be able to request a personal guarantee of 20% of the amount above £250,000.

CBILS loans are interest free for 12 months but businesses will be charged commercial rates of interest thereafter

Small firms in particular have complained so far about facing very high rates of interest. With the latest government announcements expanding eligibility and banning banks from requesting personal guarantees for loans under £250k, some of the high interest rates we are currently may continue.

However, typical interest rates so far appear to be between 3.5% – 5%. As of 2nd April, the Chancellor has written to all banks to ensure they are being transparent and offer fair rates of interest.

Straightforward loans could take up to 4 weeks to receive funds and up to 12 weeks for more complex applications

The time between applying and actually receiving the funds (time to funds for short) could be crucial to ensuring the survival of some businesses. It’s therefore worth noting that straightforward (unsecured) loans are typically taking 2-4 weeks to process whilst it could take between 4-12 weeks to received funds for more complex asset-backed applications.

Banks have had less than a week to prepare for CBILS and many have huge call centres in India which is in complete government lockdown. The latest from the banks is that they are now starting to get on top of a huge backlog of requests which should hopefully reduce the time it takes to receive funds.

Other requirements you should be aware of when applying for a CBILS loan

Whilst the scheme is technically open to all businesses with a turnover of no more than £45m, we have concluded based on experiences with CBILS to date, that the following areas are significant in determining whether your application is successful:

- Your business should have been trading for more than a year

- Your forecasts prior to the coronavirus demonstrated consistent profitability and cash flow sufficient to cover additional borrowing.

- If the business wasn’t consitently profitable before COVID-19, you’re able to demonstrate performance was improving and a clear and credible plan exists to support the turnaround plan.

- You have talked to your suppliers about extending credit, your landlord about deferring rent and undertaken other cost cutting measures to ease cash flow pressures before applying for a CBILS, and this is reflected in your forecasts.

- Whether your business was facing any short term cash flow pressure or legal action prior to the coronavirus outbreak.

- The number of major recent changes to the business (excluding the coronavirus) which would have a major impact on trading such as loss of senior management or a major contract prior to COVID-19.

- Any factors which would mean the impact of the coronavirus would be more severe for your business and indsutry compared to others.

Do not restrict your loan applications to the Coronavirus Business Interruption Loan scheme

If you are just looking at applying for a loan through the CBILS loan scheme rather than looking at the entire market, you are unnecessarily restricting yourself. Given the various pros and cons of CBILS, other routes to finance should also be assessed and evaluated in a similar fashion.

Review the entire spectrum of financing options. For example, extended overdrafts, P2P lenders and lenders who specialise in providing funding within your sector.

We can help you streamline the application process and prepare the supporting evidence required to support your CBILS claim. Use the form below or book here and Dolfinblue will provide your business with a free consultation and assessment of your eligibility for a CBILS loan.