Making tax digital; illustrative examples and solutions that help you both comply and improve your business performance.

In April 2019, there is a huge change in the way that HMRC will receive information from VAT registered businesses in the UK. The project has been dubbed “Making Tax Digital”, MTD for short, as it requires information to be transmitted to HMRC in digital form and some of the underlying records to be stored in a digital format.

Rather than viewing MTD as another regulatory burden placed on businesses, we view MTD as an opportunity to help our clients upgrade their systems, improve business performance and free up valuable time and resources. In this regard, MTD should not just be viewed as another compliance exercise but an opportunity to and innovate and improve.

Here, we discuss what options you have (with illustrative examples) for achieving a similar outcome for your business. The right solution will depend on the complexity of your business and the current systems used.

Key Changes that arise due to ‘Making Tax Digital’

It’s easy to think compliance with MTD is as simple as ensuring you file your VAT return via the correct channel but a closer look at the rules shows more careful consideration is required.

Firstly, you will no longer be able to use the government gateway portal to file your VAT returns. Here, you could compete and file your VAT return by manually keying the amounts required in each box from a spreadsheet or other offline software package you were using to perform the underlying VAT calculations.

You will also no longer be able to keep manual records. Instead, digital records must stored including:

- Designatory Data: your business name and address, VAT registration number and the VAT accounting scheme used.

- Customer and Supplier Data: the time of supply (the tax point), value of supply (net of VAT), and the rate of VAT charged

What you must do – use compatible software

These digital records must be kept in what HMRC define as “functional compatible software”.

The compatible software used to ensure compliance will typically be either an accounting package, an Excel tool or a custom integration to ensure your current system is compliant. We discuss what the best option is likely to be for your business below.

Functional compatible software keeps you compliant by storing your records in line with the new MTD rules and filing your VAT return by communicating directly with HMRC via an Application Programming Interface (API).

You therefore file your VAT return directly from the software itself rather than manually submitting VAT data via a government portal.

HMRC define functional compatible software as one program or a set of programs that must:

- Record and preserve digital records

- Provide VAT data to HMRC by using the API platform.

- Receive information from HMRC via the API platform.

Deadlines

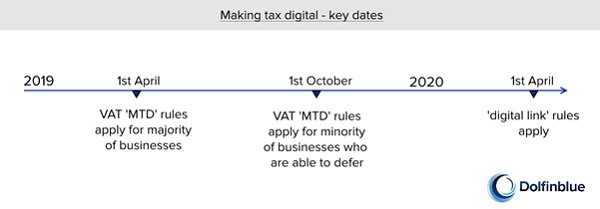

Your first VAT return which must comply with the new rules is the first VAT return which covers a period starting on or after 1st April 2019. For example, if your latest VAT return covered the three month period: March to May 2019, your first VAT return under the MTD will cover the period; June to August 2019.

There are some exceptions to this such as group registrations and businesses who use the Annual Accounting Scheme. In these instances, a six month deferral period applies. This means that MTD will apply to VAT returns that commence on or after 1 October 2019.

Finally, a business needs to have ‘digital links’ between software packages it uses, for all VAT returns starting on or after 1st April 2020. We discuss the rules around ‘digital links’ and whether they’re relevant to your business a bit later on.

The best way for your business to achieve MTD compliance

The best outcome for your business is not just to achieve compliance with the new VAT rules, but to find the most hassle-free solution that ensures compliance does not overburden the business.

In fact, one of the reasons MTD has been bought in is to encourage businesses to adopt more efficient workflows and practices for record keeping and compliance tasks. An optimal solution should therefore not only achieve compliance with MTD. An additional benefit should be the efficiency gains and cost savings from moving towards a more digital and efficient business model.

The best solution will also depend on the system or systems you currently use to prepare and submit your VAT returns.

Here we illustrate a number of different scenarios based on your current system setup as well as your appetite for using new or existing software packages to achieve VAT compliance.

Scenario 1: I run a business which is able to migrate to the cloud

We have a separate guide for businesses who are able to migrate onto a cloud software package such as Xero and QuickBooks. HMRC already regard these apps as MTD compliant. If this applies to your business, take a look at your options here.

Scenario 2: I run a larger business, with more complex requirements and use bespoke software

If you’re a larger business with more complex requirements, it’s probably not as straightforward as just switching to a cloud software solution.

We see quite a few business have particular processes around for example stock control or costing which means they rely on bespoke or industry specific software which is more adaptable to their specific needs and workflows. This makes compliance with MTD tricky as they cannot simply migrate their business to a HRMC approved system like Xero.

What not to do

When it comes to VAT, you may be using multiple pieces of software to prepare and file your VAT returns. For instance, a business may use a bespoke system to store invoices and other records and then use Excel to perform the calculations necessary to actually file the VAT return.

If you use multiple pieces of software, the MTD rules clearly state that VAT data must be transferred between the two without manual intervention such as rekeying, copying over information by hand or even the use of “cut and paste”.

Instead, there must be a ‘digital link’ between the software being used. Each piece of software must be digitally linked to other pieces of software to create the digital journey.

Functional compatible software achieves this digital link by communicating with HMRC via an API. A standalone spreadsheet however would require manual intervention to transfer VAT data onto HMRC or another software platform which is compatible.

The above illustrates one of these examples. In this instance, Excel is automatically populated from a bespoke system but a standalone spreadsheet has no digital link with HMRC.

Even if a MTD compliant software solution such as Xero or Quickbooks is instead used, you still must ensure a digital link exists between all systems such as between Excel and Xero / Quickbooks. We therefore look at various scenarios that ensure a digital link is indeed present.

Achieving a compliant and efficient solution for your business

In summary, if you’re unable to fully migrate to an off the shelf solution, you will need to ensure the system you do use is MTD compliant; that is it can:

- Record and preserve digital records

- Provide VAT data to HMRC by using the API platform.

- Receive information from HMRC via the API platform.

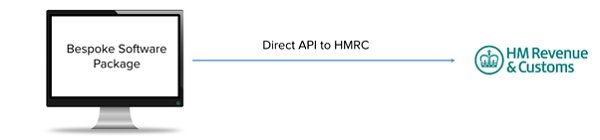

The Direct Solution

One solution would be to upgrade your current system so it meets these requirements. This may involve enquiring with your existing software provider or hiring an IT consultant to ensure the system can be upgraded to meet the three above criteria HMRC require for a system to be deemed HMRC compliant.

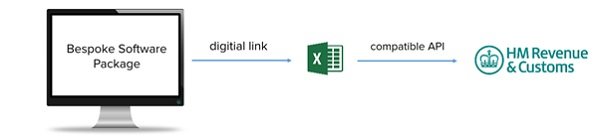

The Excel Solution

A more practical solution for many businesses would be to ensure that a digital link exists between your software and Excel.

HMRC deem the export of a CSV file from one system and the import of this CSV file into another system like Excel as an acceptable digital link.

From here, you can use an Excel Add On tool which communicates with HMRC to file your VAT returns.

HMRC has further guidance on what does and does not constitute a digital link. If you need help finding a reliable Excel tool or ensuring your systems has acceptable digital links, get in touch using the form at the bottom of this page and we’d be happy to assist.

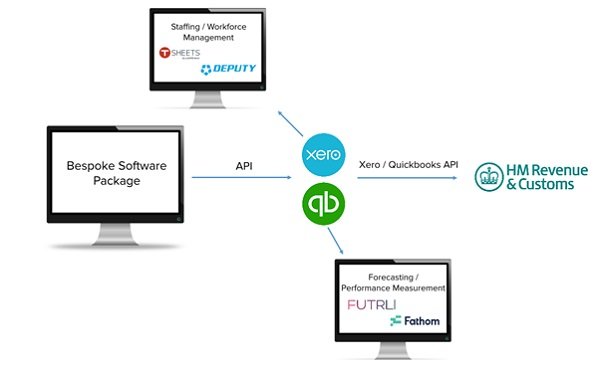

The Cloud Solution

A third solution would be to achieve MTD compliance by creating a digital link to a software provider who can then make the necessary VAT submissions to HMRC.

By using CSV files similar to above, it should be feasible for most businesses to achieve a digital link to a cloud platform like Xero or Quickbooks without having to tweak their existing software. VAT submissions can then be made to HMRC via the online accounting software.

A Future Proof Solution

For the tech savvy who see the huge opportunity technology and the cloud creates for their business, they will want to find a solution that leverages both cloud apps and tools which are compatible with their business model whilst maintaining the use of bespoke software packages for the business’s more complex workflows.

A software engineer for instance could quite feasibly use Xero’s API to build an integration between your software and the cloud; allowing systems to communicate and transfer data between one another.

In an integrated setup such as the one illustrated above, online tools could then be deployed as the backbone to financial tasks like forecasting, performance measurement and strategy development.

In a similar fashion, staffing apps could be deployed to simplify HR tasks like time tracking, staff appraisals and payroll enabling employees to focus on billable rather than admin work.

To summarise

Whatever your needs, the best solution for your business is the one that provides the most streamlined operations, the most productive workforce and the one which also takes care of compliance accurately and efficiently.

We’re sure you probably have questions. Dolfinblue can help review your current systems and implement the most effective MTD compliant solution for your business.

Drop us a line using the form below and one of the team will be in touch.