How capturing data and evaluating your performance can provide you with the competitive edge.

Why you need to monitor business performance

One of the most important tasks successful business owners undertake is monitoring their financial performance on a regular basis. Management who understand where the business currently stands from a performance standpoint as well as where it’s heading hold a huge advantage over those who choose not to.

A lot of businesses owners make key decisions based on gut feelings. This is an incredibly risky way to run a business. Monitoring financial performance on the other hand provides key insights that help you answer questions about your business like:

- What are the most and least profitable areas of the business?

- Is the business gaining or losing financial strength?

- Am I performing in line with my objectives and business plan?

- What price point maximises profits?

- How much cash will the business generate over the next 12 months?

- How did we perform this month compared to last month?

Success in business comes down to how successful we are in answering these types of questions and making correct decisions based on what we’ve learnt.

By monitoring performance and gaining these types of insights, you’re inevitably able to make better business decisions and improve your business’s performance over the long term.

Managing uncertainty and risks in business

Monitoring your financial performance therefore creates more certainty and confidence in making both short and long term decisions. This in turn leads to a healthier business and faster growth rate.

It also allows you to outperform and outmanoeuvre competitors who fail in this regard. By capturing data and monitoring their performance, you have a consistent and effective platform for making decisions; something rivals do not possess. Management can then use this business intelligence to navigate the business through both good times as well as the more uncertain and volatile periods.

In fact, the most valuable companies in the world use data in this way.

A key part of their success is their ability to use the data they collect to drive the business forward. In an increasingly competitive global marketplace, understanding your key performance metrics such as product profitability, cash flow, customer preferences, staff productivity etc provides you with a vital competitive edge.

How small and medium businesses can monitor their performance

You would be forgiven for thinking that capturing data and monitoring performance should just be the prerogative for businesses with large budgets who can absorb the cost and complexity of implementing such systems.

However, the rise of cloud applications provides a low cost flexible solution that businesses of all shapes and sizes can implement without breaking the bank. In today’s tech enabled world, there’s nothing to stop business both small and large, with different budgets and different resources at their disposal from monitoring their business and improving performance as a result.

Financial monitoring tools like Futrli, Spotlight and Fahthom to name a few, therefore present one of the biggest opportunities SMEs have had in decades to future proof their business and level the playing field against their larger counterparts.

Small businesses are spoilt for choice when it comes to app choice

Tools for monitoring business performance

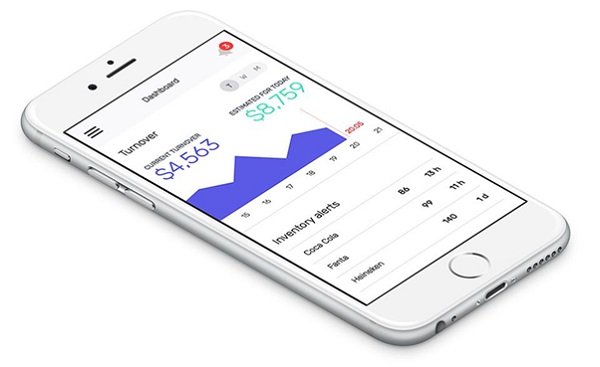

These tools provide you with a performance dashboard that enable you to monitor your goals, the progress you make and all the key performance metrics throughout your business. By integrating with your accounting and other software you use to run your business, they automate data flow and provide real time information.

These tools therefore allow you to track your financial metrics such as profit margins, cash flow and other key financial and accounting ratios. However, your performance dashboard can also track your non-financial metrics (such as customer happiness and process efficiency); ensuring you have all the information you need to manage your business effectively.

An example of a performance dashboard in action

They also crucially allow business owners to monitor their budgets and forecasts in real time. You can set your goals and targets for the year ahead, and track the progress you make in achieving these.

The importance of business planning is a topic in itself but sticking to your plan we often find is the hardest part. Tools which track your performance help you overcome this challenge as it ensures you don’t lose sight of your targets and empowers you to take corrective action when things fall out of line.

How frequently should I be monitoring business performance?

The frequency you monitor your performance varies depending on your sector and whether you’re a relatively new business with ambitious growth plans or a more mature business looking to consolidate your position.

For instance, a fast moving industry like retail or hospitality where there are many moving parts, will look at their performance metrics daily. Smaller businesses with a steadier and more predictable flow of work, may review performance weekly or monthly instead. Either way, the common denominator is that they continually review the important numbers in their businesses and make decisions quicker as a result.

Fast moving industries like bars and restaurants will need to review their business more frequently than others.

What performance metrics and financial ratios should I be monitoring?

Once you have decided which tool to use to monitor business performance, it’s time to think about exactly what metrics you need to track and review.

Selecting the right ones will depend on your industry, your goals, the risks your business faces and what department you’re looking to track. For instance, you may wish to track your marketing activity to ensure it’s making the company money and to understand what can be done to attract more customers. You therefore may wish to monitor lead generation, your lead to customer ratio and your marketing return on investment.

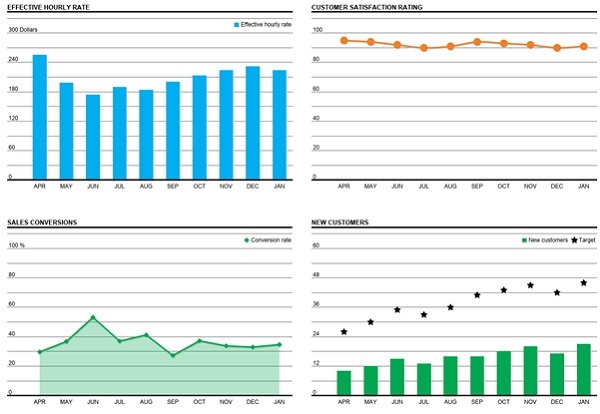

A number of marketing key performance indicators (KPIs)

On the financial side, you will want to understand your profitability by tracking ratios such as your gross and net profit margin. You will want to ensure your business is healthy by monitoring your cash flow so you can spot any downward trends. You may wish to monitor financial ratios such as debtor days so you can assess whether customers are paying on time. If you’ve raised finance to support your growth, you will want to track your quick and current ratios for instance to ensure that the business is able to meet its debt obligations.

Whatever your business does, the key thing to keep in mind is that the metrics you track should help you make better decisions and improve business performance. They should help you answer key questions such as: What are the key drivers of growth, profit and cash? Are we on track to achieve our targets and objectives? Is my business sustainable over the short and long term? What are the most and least profitable areas of my business?

How to implement performance monitoring into your business

Once you’ve established what metrics you need to track, how frequently they should be monitored and what financial tool best suits your needs, it’s time to consider how to implement performance monitoring into the business so it becomes a key tool for making decisions and achieving your objectives. Here we touch on two key ways you can do this.

Management Accounts

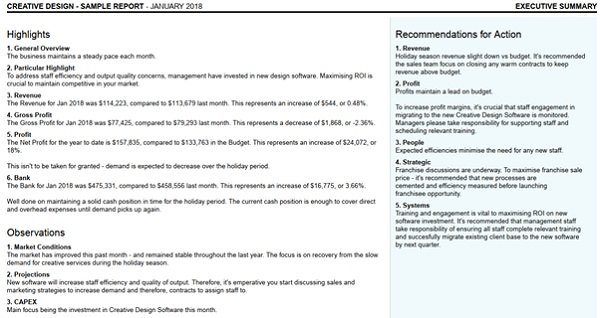

The first place to start is to produce management accounts on a regular basis which for SMEs is often on a monthly or quarterly basis. A good set of management accounts needs a few core sections for it to be a useful and practical tool for better decision making.

We have established our own methodology to deliver meaningful management accounts with commentary and accountability to ensure you have quality information and a clear action plan for moving the business forward. This includes:

- Summary: this page explains the key drivers of performance, what’s happened and identifies the next actions to take based on your results

An example of a summary report

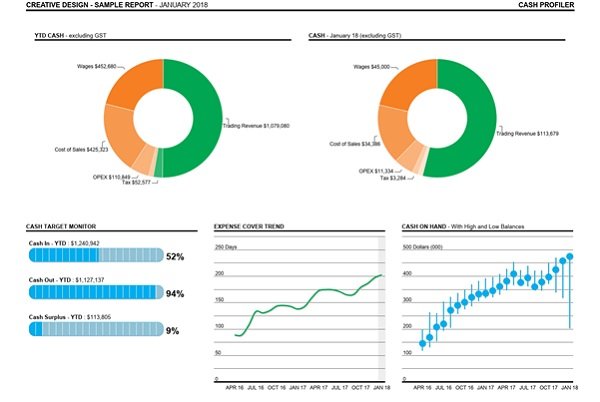

- Financial Fundamentals: this is what we call the summary profit & loss account, balance sheet and cash flow documents with comparisons to your budget and prior year

- KPI and Analysis: Key Performance Indicators (KPIs) are used in the business to monitor progress towards its goals and objectives.

An extract with visual analysis of business expenditure and cash inflows and outflows.

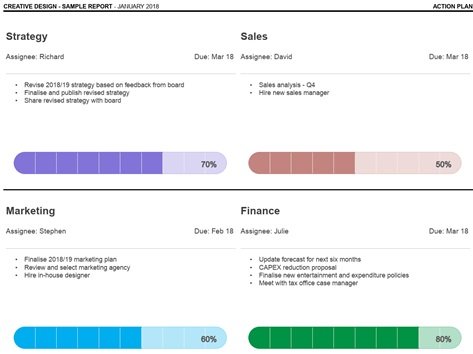

- Action Plan: this is the link between monitoring and improving your performance. As business advisers, we help you set goals and agree specific actions for your team that will help you get there.

Action plans allow you to set actions and monitor progress.

- Appendices: this is where you will find the finer detail. If you need deeper insights to support a particular business activity, this is where we include all the relevant performance reports to assist with this.

Performance Dashboards

We’ve already touched on performance dashboards as a great way to keep an eye on your performance when you do not require the level of detail provided by management accounts.

If you’re looking for instant performance insights that allow you to check everything’s running smoothly at a glance, performance dashboards are the right tool to use.

All the tools and apps which are widely used for performance monitoring (including Futrli, Fanthom and Spotlight mentioned above) include a performance dashboard as standard. Even better, they’re available on your smartphone via the app store, your PC or any internet connected device. This enables you to keep an eye on your business and operations wherever you happen to be working from.

In summary

To summarise, capturing data and monitoring your business operations is vital to improving your performance and maintaining a healthy profitable business. If you know your numbers and you know how to interpret them, you know your business. As a business owner or leader, that’s a good place to be!

As Chartered Accountants and Business Advisers, Dolfinblue can help you with this vitally important task. When it comes to performance measurement, we ensure our clients have the insight, analysis and advice they need to run a profitable thriving business:

We help you answer the key questions:

- What performance monitoring tool is right for your industry, your business and your specific needs?

- What information, metrics and ratios you should I be tracking and monitoring?

- What is the information telling me about my current and future performance?

- What do I need to do next to drive the business towards its goals and objectives and make more money?

If you have any questions, we’d love to hear from you. Drop us a line below and one of our friendly finance experts will be in touch to get the conversation started.